5 Ways Your Saskatchewan Life Costs More Than it Did 5 Years Ago

I'm talking before inflation, interest rate hikes & everything else murdering your bank balance right now.

A couple billion in PST increases here, a few more in mismanaged pandemic spending there - it adds up, quickly. Somebody has to pay for it.

Right now in Saskatchewan, just on the five points I’m going to lay out for you here, a family of four has shelled out an average of an extra $52,000 thanks to Sask Party rate hikes, overspending and the Ministry of Health’s pathetic mismanagement of the pandemic.

That’s $52,000 in addition to what you were already paying by way of provincial rates, taxes, utilities etc.

This is how that breaks down*.

1. Increased PST Rate From 5% to 6%

In March of 2017 Brad Wall delivered his last provincial budget as premier by increasing the PST rate in Saskatchewan from five to six percent. At the time it was announced, the hike was projected to cost Saskatchewan consumers an additional $242-million that year.

However when you toss in the fact that alongside the percentage hike that year, the Sask Party government also imposed the PST on children’s clothing for the first time in Saskatchewan history, as well as onto things like restaurant meals, snack foods and renovating your home, it actually cost residents an additional $800-mil.

According to Saskatchewan’s Public Accounts documents (I’m not providing a link to each number I use in this post cause I’d be hyperlinking all day long, but they are available here if you’d like to look yourself), in the four fiscal years prior to the Sask Party’s 2017-18 hike, we paid around $1.25-bil in PST in the province annually.

The 2017 PST increases jacked that number to slightly over $2-billion, which is where it has stayed since.

That’s an average increase of $700 per year for every man, woman and child in Saskatchewan.

That’s an additional average $14,000 piled on to the cost of living for a Saskatchewan family of four to cover the Sask Party’s PST hike, since it was imposed in 2017.

Today a Saskatchewan family of four is paying an average of $8000 per year in PST.

2. Poured Billions Into Vanity Projects

Did we need a new stadium in Regina?

I can’t say we didn’t, but that ship has sailed anyway.

It’s the $1.8-billion ring around Regina’s posey that you’ll be paying for until you die that you should be concerned about.

When they finally opened the Regina Bypass in late 2019, the Saskatchewan government insisted 21,000 vehicles per day would use it. Three months later, when reported usage was about 5600 per day, they were forced to clarify that they meant 21,000 vehicles in the year 2040.

Ohhhhh.

It isn’t going to happen then either.

I looked for a traffic usage report for the Regina Bypass, but didn’t look that hard because a) you already know from personal experience that it’s empty year-round and b) unsurprisingly, it’s not information that appears readily available.

The Regina Bypass, a P3, or rent-to-own project, was supposed to cost Saskatchewan residents $1.8-billion total. You’ve already paid the company that built it $1.6-billion and we’re going to be paying them millions of dollars every year until the year 2049 for interest and “maintenance”.

However I’ll just count what we’ve paid in the last five years, which is approximately $1-bil, or around $900 each, for the Regina Bypass.

That doesn’t include the Global Transportation Hub (GTH) specifically the really expensive “free-flow” interchange that Bill Boyd just had to have, along with the parcels of land it would need to be constructed on.

The provincial government refuses to break down the costs, but you and I both know that between the Regina Bypass and the GTH, a sick amount of money went to Sask Party donors and supporters in sketchy land deals and beyond.

Anyway, over the past five years a Saskatchewan family of four has shelled out an average of $18000 to pay for the Regina Bypass (whether they use it or not).

3. Debt Financing

The spring provincial budget exercise is political theatre.

A simple tweak of their projected West Texas Intermediate (WTI) oil price, for example, before the budget document goes to print, can add or remove hundreds of millions of dollars from forecasted revenue.

This makes “balancing” a planned budget really not that hard, because it’s not much more than an educated (hopefully) guess.

The Government of Saskatchewan’s Public Accounts documents that reconcile what the government forecasted against its actual revenue and expenses are a hot mess of restatements and revisions.

Debt (which is the current total amount of Saskatchewan’s accumulated debt) and deficits (the negative difference between our annual revenue and expenses) aren’t a particularly sexy political topic. The amounts are always so astronomical that they’re difficult for voters to process. Plus, doesn’t every province borrow money and run up debt?

Sure.

For capital projects, which produce assets, this is fine.

But Saskatchewan has been borrowing to operate.

Regardless of your position on government debt, you should still know what Saskatchewan government borrowing is costing us.

On this one, Public Accounts documents are pretty straightforward:

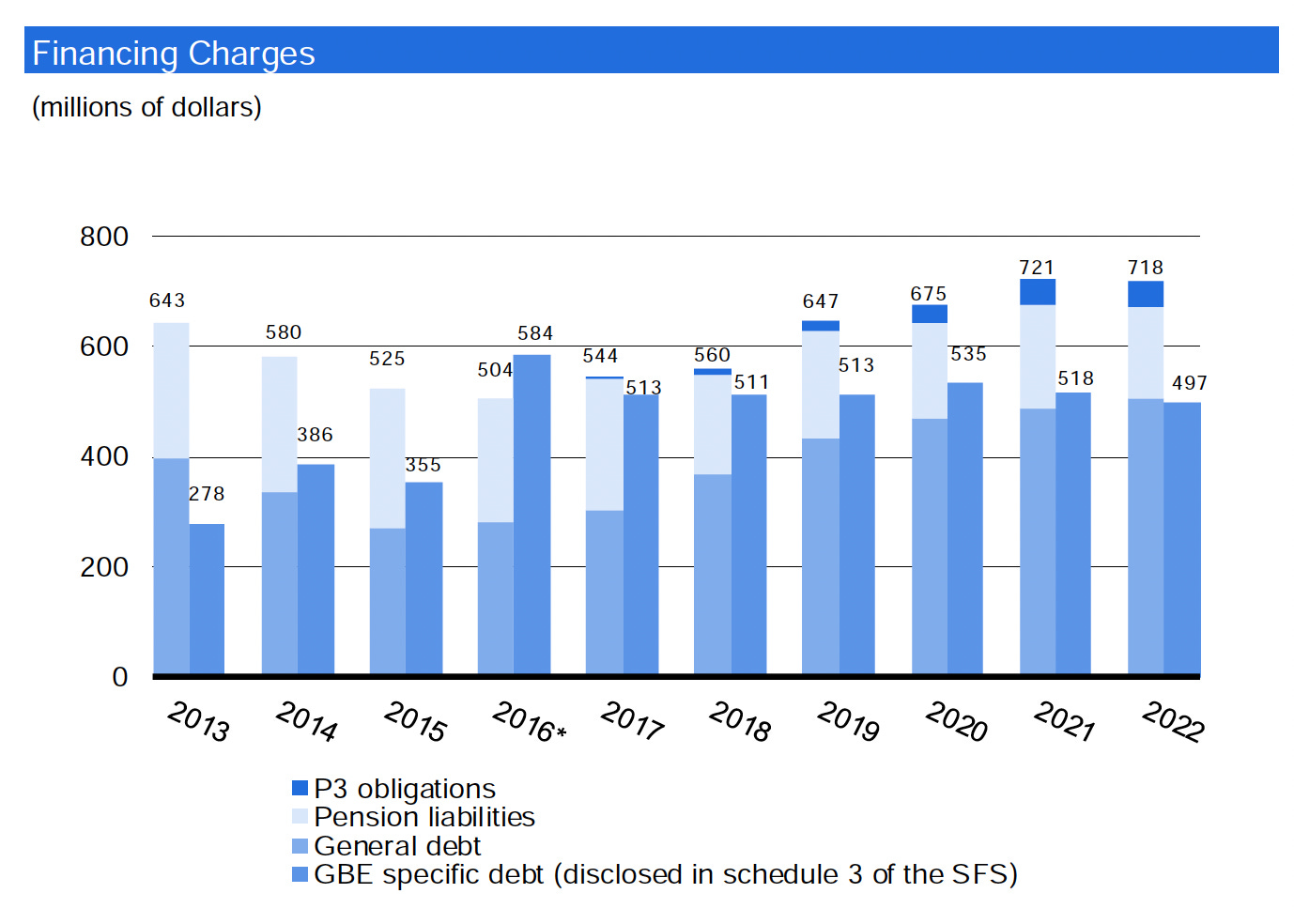

General debt in Saskatchewan has nearly doubled in five years.

Here’s what that’s costing you:

The second, lower-dollar-amount column reflects the debt of Government Business Enterprise (GBE), ie. Crown Corporations.

It doesn’t matter. It’s all one pot.

It’s all one debt.

Yours.

Saskatchewan residents have paid over $5.8-billion over five years just in interest and borrowing service charges on Sask Party government spending, including P3s.

That equals approximately $5,000 in charges for every man woman and child in Saskatchewan, or another $20,000 in average costs over five years per family of four just to cover the cost of the Sask Party government’s borrowing.

4. Pointless Supreme Court Battles

In April 2018, Scott Moe, flanked by Don Morgan and Dustin Duncan and their best “this is serious, pay attention” faces, announced he was going to challenge the federal government’s carbon tax all the way to the Supreme Court of Canada (SCOC)

He did and he lost.

Moe’s first loss in this battle happened in is own province.

In May 2019 the Saskatchewan Court of Appeal determined, though not unanimously, that the federal carbon tax was constitutional. Two years after that, the SCOC finished Moe’s battle for him by deciding the same thing.

The only thing I could find on what that gong show cost us was on June 17, 2020, when Don Morgan said in committee that the government paid MLT Aikens $500,000 just to prepare the Supreme Court application. He said MLT had teamed up with lawyers from the Ministry of Justice, so you can at least double that figure.

Now toss in the salaries of at least six full-time civil servants to manage the whole debacle between 2018 (likely long before) and 2021.

Plus travel and expenses, plus the court costs for Saskatchewan residents of the provincial Appeals Court process… PLUS the cost of the Supreme Court process (which is paid by all Canadian residents).

You’re easily at $10-mil.

Perhaps not a lot of money, but think of all the incremental cuts to other programs in Saskatchewan that have created heartache. Think about the aspects of health care, including but not limited to harm reduction and life-saving prescription drugs, this government refuses to pay for, or is trying to sell-off for pennies on the dollar.

Now look again at $10-mil of your money, spent on lawyers and bureaucrats, purely as a promotional stunt for Scott Moe.

Are you okay with that?

5. Mismanage a Pandemic

By the end of the 2014-15 fiscal year, the Sask Party had spent $14-billion operating the province. That expense number jumped to $15-billion the following year and hovered there until 2021-22, when expenses jumped to $19-billion.

Yet, according to Public Accounts, that’s to be blamed on farmers.

Try not to focus on the fact that as a percentage of its annual expenses, Sask Party spending on health care barely moved through the COVID-19 pandemic and then inexplicably dropped in 2021-22.

That education percentage is fascinating too, but for a different day.

According to the Government of Saskatchewan, its agriculture expense increased by 507%, or $3-billion, in 2021-22 over the year before, due to drought payouts from Saskatchewan’s Crop Insurance Corporation.

When Donna Harpauer floated this idea last winter, farmers weren’t super excited about being blamed for a massive blow to Saskatchewan’s public purse.

Because the reality is Saskatchewan’s Crop Insurance Corporation should have had the money in its bank account to payout those claims, thanks to its multi-billion dollar accumulated cash surplus.

Except the Sask Party has withdrawn that cash surplus and spent it on government operations, meaning that was a stunningly misleading statement from a Minister of Finance.

We see evidence of that a few pages later in a different type of chart, where it’s obvious operating costs in 2021-22 comprised at least some of the increased expenses.

We know hundreds of millions of dollars in pandemic-related money went to Saskatchewan Party donors small businesses, we just don’t know which ones. We do know the COVID-19 pandemic was grossly mismanaged by Scott Moe and Paul Merriman.

It’s going to be decades before we know the true costs of Moe and Merriman’s decisions, or refusal to make them, during the pandemic, but you can safely assume it’s going to be in the billions.

For the sake of this post I’m going to go with $2-billion thrown away on pandemic mismanagement. That’s $1800 for every man, woman and child in Saskatchewan and just under $10,000 per family of four.

Honorable Mentions

In 2022-23’s provincial budget your property tax rate was jacked. Everyone’s went up.

They must be running out of things to apply the PST to, because in 2022-23 the Sask Party slapped an extra six percent onto your sports and concert tickets, as well as your smokes and booze, if that’s your thing.

In its 2017-18 budget the Sask Party government got rid of the bulk fuel PST exemption for Saskatchewan farmers.

In the three fiscal years from 2014-15 to 2016-17, ‘Road-Use Fuel Tax Revenues’ (or RUFTR) (we’ll stick with “fuel tax”) declined by $10-million.

In 2017-18, the year the bulk fuel tax exemption for Saskatchewan farmers was lifted, the province’s fuel tax revenue increased by $30-million.

Thanks Saskatchewan farmers!

*Is this a perfect science, or am I an economist? Hell no. I understand that costs aren’t usually broken down the way I’ve laid out. That does not mean the “man, woman and child” breakdown isn’t valid, however.

I’m also not capturing things like inflation, rental rates etc.

You have to have a frame of reference. The odds are really good all of what I’ve laid out costs even more than what I’ve estimated, but you have to start somewhere to begin to grasp how inappropriate and unskilled this government really is when it comes to fiscal management.

Enjoy your (cooler) week. You have to love the five minutes in Saskatchewan in which we can consider +27C a more manageable and comfortable temperature than we had last week.